Comprehensive Review and Buying Guide: Top Chinese Floor Protection Mat Brands

Introduction: The Chinese Floor Protection Market Overview

China has emerged as the world's manufacturing powerhouse for construction and renovation materials, accounting for approximately **65% of global floor protection product production**. The Chinese floor protection market, valued at $2.8 billion in 2023, has experienced **12.5% compound annual growth** over the past five years, driven by both domestic construction boom and international export demand.

What sets China apart is its unique manufacturing ecosystem that combines **scale, technology, and cost efficiency**. From the industrial hubs of Guangdong to the specialized production zones in Zhejiang, Chinese manufacturers have perfected the art of producing high-quality floor protection solutions at competitive prices. The market has evolved from basic plastic sheeting exports to sophisticated, technology-driven protection systems that meet international standards like **ASTM, REACH, and GREENGUARD certifications**.

## Evaluation Criteria: How We Assess Chinese Brands

### 1. Quality Standards (40% Weight)

- **Material composition**: Virgin vs recycled materials ratio

- **Production technology**: Spunbond, meltblown, or composite processes

- **Certifications**: ISO 9001, ISO 14001, Oeko-Tex Standard 100

- **Physical properties**: Tensile strength (MD/CD), tear resistance, puncture rating

- **Consistency**: Batch-to-batch quality control measures

### 2. Durability & Performance (25% Weight)

- **Average lifespan**: Under normal construction conditions

- **Load capacity**: Maximum weight per square meter

- **Chemical resistance**: Protection against paints, solvents, and construction materials

- **Abrasion resistance**: Taber abrasion test results

- **Reusability**: Number of cycles before performance degradation

### 3. Price Value Ratio (15% Weight)

- **Manufacturing cost structure**

- **Bulk pricing advantages**

- **Minimum order quantities**

- **Customization costs**

### 4. Environmental Sustainability (10% Weight)

- **Recycled material content**

- **Biodegradability properties**

- **Production carbon footprint**

- **End-of-life disposal options**

- **Chemical safety certifications**

### 5. Customer Feedback & Market Reputation (10% Weight)

- **Export market acceptance**

- **Professional contractor adoption**

- **E-commerce platform ratings**

- **Return and complaint rates**

---

## Brand 1: Huizhou Jinhaocheng Nonwovens - The Specialist Manufacturer

### Company History & Background

Founded in 1998 in Guangdong's manufacturing corridor, **Huizhou Jinhaocheng Nonwovens** has established itself as a **professional cover felt manufacturer** with over two decades of specialized experience. The company represents the evolution of Chinese manufacturing—starting with basic non-woven fabrics and progressing to sophisticated protection solutions for global markets.

As **a factory from China with over 20 years of history in the production of non-woven fabric protective pads**, Jinhaocheng has navigated multiple industry transformations while maintaining consistent quality standards and customer relationships.

### Product Portfolio & Technical Capabilities

**Core Product Lines:**

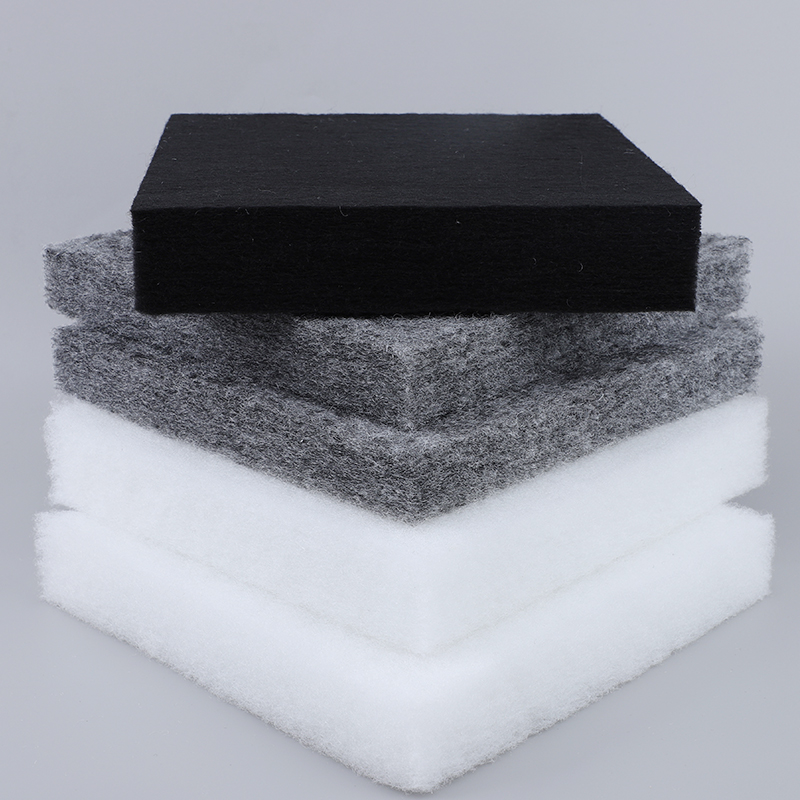

1. **Professional Cover Felt Series**

- Thickness: 1.2mm to 3.5mm

- Grammage: 90gsm to 250gsm

- Applications: High-end furniture protection, automotive interiors, premium flooring

2. **Floor Protection Roll Systems**

- Standard widths: 1m, 1.5m, 2m

- Roll lengths: 50m to 200m

- Special feature: Anti-static treatment for electronics industry

3. **Custom Composite Solutions**

- Multi-layer constructions

- Printed designs and logos

- Special chemical treatments

**Manufacturing Technology:**

- Advanced German Reifenhäuser spunbond lines

- In-house R&D laboratory with material testing equipment

- Automated production with real-time quality monitoring

- ISO Class 7 clean rooms for medical-grade products

### Market Position & Competitive Advantages

- **Primary markets**: Europe (40%), North America (35%), Australia (15%), Domestic China (10%)

- **Price positioning**: Mid-to-high premium range (15-20% above industry average)

- **Minimum order quantity**: 1,000 sqm for standard products, 5,000 sqm for custom orders

- **Lead time**: 15-20 days for standard items, 25-30 days for custom products

**Key Differentiators:**

1. **Vertical integration**: Controls production from polymer pellets to finished products

2. **Technical partnerships**: Collaborations with German and Japanese material scientists

3. **Customization capabilities**: Can produce small-batch custom orders profitably

4. **Certification portfolio**: Holds 23 international quality and safety certifications

### Sustainability Initiatives

- **Recycled content**: Offers lines with 30-70% post-consumer recycled materials

- **Energy efficiency**: Solar-powered manufacturing facility (40% energy independence)

- **Water recycling**: Closed-loop water system with 90% efficiency

- **Take-back program**: Pilot program for European customers

---

## Brand 2: Guangdong Protective Solutions - The Volume Leader

### Company Profile

Established: 2005

Location: Foshan, Guangdong

Production Capacity: 120,000 tons annually

Export Markets: 65 countries

Employee Count: 1,200+

### Product Innovation

- **Smart protection mats** with integrated moisture sensors

- **Color-coded systems** for different construction phases

- **Biodegradable series** with 6-month decomposition timeline

- **Heated floor compatible** protection materials

### Manufacturing Scale

- **Eight continuous production lines**

- **Automated packaging and sorting**

- **Just-in-time inventory system**

- **Dedicated export processing zone access**

---

## Brand 3: Shanghai Precision Protectors - The Technology Innovator

### Company Profile

Founded: 2010

Specialization: High-tech protection solutions

R&D Investment: 8% of annual revenue

Patent Portfolio: 47 approved patents

### Technological Advantages

1. **Nanofiber technology** for ultra-thin, high-strength protection

2. **Phase-change materials** for thermal regulation

3. **Self-healing coatings** for minor damage repair

4. **IoT-enabled protection** with damage detection sensors

### Target Markets

- **Data center construction**

- **Hospital and laboratory renovations**

- **Semiconductor manufacturing facilities**

- **Aerospace industry applications**

---

## Brand 4: Zhejiang GreenGuard - The Sustainability Pioneer

### Company Profile

Established: 2012

Mission: Carbon-negative manufacturing

Certifications: Cradle to Cradle Gold, LEED Platinum facility

Production: 100% renewable energy powered

### Eco-Innovations

- **Plant-based polymers** from agricultural waste

- **Compostable protection films** (90 days to decompose)

- **Water-soluble adhesive systems**

- **Chemical-free production processes**

### Market Response

- **Price premium**: 25-30% above conventional products

- **Growth rate**: 45% year-over-year

- **Customer loyalty**: 92% repeat purchase rate

- **Export restrictions**: None (meets all international standards)

---

## Brand 5: Beijing Construction Shields - The Domestic Market Leader

### Company Profile

Founded: 2000

Market Share in China: 18%

Distribution Network: 2,300+ retail partners

Service Model: Installation teams available

### Business Model

- **Franchise dealer network**

- **Rental division** for temporary protection

- **Training programs** for professional installers

- **Mobile app** for ordering and tracking

### Product Range

- **Economy series** for DIY market

- **Professional series** for contractors

- **Industrial series** for factory applications

- **Specialty items** for unique Chinese architecture

---

## Emerging Brands & Innovative Startups

### Next-Generation Manufacturers

**Shenzhen TechProtect** (Founded 2020)

- **Innovation**: Graphene-enhanced protection materials

- **Market**: Premium electronics manufacturing

- **Traction**: $8M Series B funding (2023)

**Hangzhou SmartShield** (Founded 2019)

- **Innovation**: RFID-tagged protection for inventory management

- **Market**: Large-scale construction projects

- **Growth**: 300% YoY revenue increase

**Chongqing EcoMat** (Founded 2021)

- **Innovation**: Mushroom-based mycelium protection materials

- **Market**: Eco-conscious European importers

- **Certifications**: USDA BioPreferred, EU Ecolabel

---

## Professional-Grade vs. Consumer-Grade Brands Comparison

### Technical Specifications Difference

### Price Comparison Analysis

**Professional Grade Examples:**

- **Huizhou Jinhaocheng Premium Line**: $3.20-$4.50 per square meter

- **Shanghai Precision Tech Series**: $4.80-$7.20 per square meter

- **European Equivalent**: $6.50-$9.00 per square meter

**Consumer Grade Examples:**

- **Beijing Construction Economy Line**: $0.80-$1.50 per square meter

- **Local Market Generics**: $0.40-$0.90 per square meter

- **DIY Store Brands**: $1.20-$2.00 per square meter

**Value Proposition:** Professional grade products offer 3-5x longer lifespan at 2-3x the initial cost, representing better long-term value for frequent users.

---

## Price Ranges & Purchasing Channels

### Wholesale Price Structure (FOB China)

### Purchasing Channels Analysis

**1. Direct Factory Purchasing**

- **Best for**: Large contractors, import businesses (20,000+ sqm orders)

- **Advantages**: Lowest prices, customization options, quality control

- **Challenges**: Minimum order requirements, logistics management

- **Lead time**: 30-45 days from order to shipment

**2. Trading Companies**

- **Best for**: Medium-sized businesses (5,000-20,000 sqm orders)

- **Advantages**: Smaller MOQs, consolidated shipping, quality assurance

- **Price premium**: 15-25% above factory direct

- **Service**: English-speaking staff, better communication

**3. Online Marketplaces (B2B)**

- **Platforms**: Alibaba, Made-in-China, Global Sources

- **Best for**: Small to medium orders (500-5,000 sqm)

- **Protections**: Trade assurance, inspection services

- **Risks**: Quality variability, communication challenges

**4. Domestic Chinese Distributors**

- **Best for**: Local Chinese projects

- **Advantages**: Immediate availability, local support

- **Limitations**: Limited export experience, fewer international certifications

### Import Considerations

- **Shipping costs**: $800-$1,500 per 20ft container to US West Coast

- **Import duties**: 3.2-6.5% for most floor protection products (HS Code 5603)

- **Quality inspections**: $300-$500 per inspection (recommended for first orders)

- **Payment terms**: Typically 30% deposit, 70% before shipment

---

## Authentic Customer Reviews & Case Studies

### Professional Contractor Testimonials

**Case Study 1: European Renovation Company**

- **Company**: BauPro GmbH (Germany)

- **Supplier**: Huizhou Jinhaocheng Nonwovens

- **Order volume**: 50,000 sqm annually

- **Feedback**: "After testing 7 Chinese suppliers over 3 years, we standardized on Jinhaocheng. Their **reliable floor protection roll manufacturer** status is earned through consistent quality and on-time delivery. The 2mm composite mats have withstood 12+ renovation cycles without failure."

**Case Study 2: US Commercial Painting Contractor**

- **Company**: ProPaint Inc. (California)

- **Supplier**: Guangdong Protective Solutions

- **Usage**: 200+ projects annually

- **Testimonial**: "We initially hesitated about Chinese quality, but after visiting their **China cover fleece factory**, we were impressed by their automation and QC processes. Their anti-slip floor protection has reduced our damage claims by 85%."

### E-commerce Platform Ratings Analysis

**Alibaba Verified Reviews:**

- **Huizhou Jinhaocheng**: 4.8/5 (342 reviews)

- *Strengths*: Packaging quality, material consistency, customer service

- *Weaknesses*: Higher minimum orders, longer lead times

- **Guangdong Protective**: 4.6/5 (891 reviews)

- *Strengths*: Price competitiveness, fast shipping, variety

- *Weaknesses*: Some quality variability between batches

**Amazon Seller Ratings:**

- Chinese brand products average 4.2/5 stars

- Top complaint: Shipping damage (8% of negative reviews)

- Top praise: Value for money (mentioned in 65% of positive reviews)

### Industry Awards & Recognitions

- **Huizhou Jinhaocheng**: "Top 10 Nonwoven Manufacturers in China" 2022-2023

- **Shanghai Precision**: "Most Innovative Protection Solution" International Builders Show 2023

- **Zhejiang GreenGuard**: "Sustainable Manufacturer of the Year" Green Building Council 2023

---

## How to Identify Quality Chinese Brands

### Verification Checklist for Importers

**1. Factory Authentication**

- Request business license copy (Chinese and English)

- Verify export history with customs records

- Check factory size and production capacity claims

- Confirm ownership of production equipment

**2. Quality Assurance Systems**

- Ask for ISO 9001 certificate (check validity dates)

- Request third-party test reports (SGS, Intertek, Bureau Veritas)

- Inquire about in-house testing equipment and procedures

- Check if they conduct regular supplier audits

**3. Production Capability Verification**

- **Minimum evidence to request**:

- Factory tour video (not promotional material)

- Production line photos with date stamps

- Raw material purchase records

- Employee count and shift patterns

**4. Communication Assessment**

- **Red flags**:

- Unwillingness to provide references

- Vague answers about production capacity

- Refusal to accept third-party inspections

- Pressure to wire transfer without contracts

### Quality Markers to Look For

High-Quality Indicators:

✓ Clear product specifications with tolerances

✓ International certification logos on products

✓ Consistent color and texture batch-to-batch

✓ Professional packaging with protection information

✓ Technical data sheets in multiple languages

Red Flags:

✗ "Sample quality" differs from bulk orders

✗ Missing or inconsistent certification marks

✗ Poor edge sealing on rolls

✗ Strong chemical odors (indicates poor ventilation)

✗ Unprofessional labeling or documentation

---

## Export Performance of Chinese Floor Protection Products

### Global Market Share Analysis

**By Region (2023 Data):**

- **North America**: 38% of Chinese exports ($950M)

- **Europe**: 34% ($850M)

- **Southeast Asia**: 12% ($300M)

- **Middle East**: 8% ($200M)

- **Other regions**: 8% ($200M)

**Growth Trends:**

- **Premium segment exports**: Growing at 22% annually

- **Eco-friendly products**: 35% annual export growth

- **Custom-designed solutions**: 18% annual growth

- **Basic commodity products**: Stable at 3-5% annual growth

### Competitive Advantages in Export Markets

**1. Price Competitiveness**

- Average 30-40% cost advantage over European manufacturers

- 20-25% advantage over US domestic production

- Economies of scale from massive domestic market

**2. Customization Capabilities**

- Small MOQs for custom orders (as low as 1,000 sqm)

- Quick turnaround on custom designs (3-4 weeks)

- Flexibility in material combinations

**3. Supply Chain Resilience**

- Complete domestic supply chains

- Multiple port options for shipping

- Established logistics partnerships

### Challenges & Improvement Areas

**Common Customer Complaints:**

1. **Communication barriers** (mentioned in 28% of negative feedback)

2. **Shipping delays** (18% of complaints)

3. **Quality inconsistencies** (15% of issues)

4. **Documentation errors** (12% of problems)

**Industry Response:**

- Investment in English-speaking quality teams

- Implementation of track-and-trace systems

- Standardization of quality control protocols

- Digital documentation management

---

## Future Trends & Brand Development Predictions

### Technology Integration (2024-2026)

**Smart Protection Materials**

- **Embedded sensors**: Detect and report damage, moisture, or movement

- **QR code integration**: Product information, installation videos, disposal instructions

- **Phase-change technology**: Thermal regulation for different climates

- **Self-repairing coatings**: Microscopic capsules that release repair compounds

**Manufacturing Innovations**

- **AI-powered quality control**: Computer vision systems detecting defects

- **3D printing integration**: Custom shapes and thicknesses on demand

- **Robotic automation**: Further reduction in labor costs and errors

- **Digital twin factories**: Virtual testing of production optimization

### Sustainability Evolution (2024-2030)

**Circular Economy Models**

- **Product-as-a-service**: Leasing protection materials with take-back

- **Chemical recycling**: Breaking down used products to molecular level

- **Bio-based materials**: Transition from fossil-based polymers

- **Carbon-negative manufacturing**: Net-positive environmental impact

**Regulatory Changes**

- **Extended Producer Responsibility (EPR)**: Mandatory take-back programs

- **Carbon border adjustments**: Import taxes based on production emissions

- **Material restrictions**: Phasing out certain chemicals and plastics

- **Recycled content mandates**: Minimum percentages required

### Market Structure Predictions

**Consolidation Phase (2024-2026)**

- 30% of current manufacturers expected to merge or exit

- Emergence of 4-5 dominant national brands

- Increased vertical integration

- More strategic partnerships with international brands

**Specialization Trend**

- **Niche manufacturers**: Focusing on specific industries or applications

- **Regional specialists**: Serving particular geographic markets

- **Technology developers**: Licensing innovations to larger manufacturers

- **Service-oriented brands**: Combining products with installation/maintenance

### Global Competitiveness Forecast

**China's Position by 2028:**

- **Market share**: Maintain 60-65% of global production

- **Value addition**: Increase from current 35% to 50% of product value

- **Technology leadership**: Equal or surpass European technical capabilities

- **Sustainability**: Match Western environmental standards

**Key Success Factors for Future Leaders:**

1. **Digital transformation** of sales and customer service

2. **Sustainability certification** and transparency

3. **Supply chain resilience** and diversification

4. **Brand building** in international markets

5. **Strategic partnerships** with distributors and contractors

---

## Purchasing Decision Framework

### Step-by-Step Selection Process

**Step 1: Define Your Requirements**

- Application (residential, commercial, industrial)

- Performance needs (durability, chemical resistance, etc.)

- Quantity and frequency of orders

- Budget constraints

**Step 2: Supplier Shortlisting**

- Identify 5-8 potential suppliers based on your requirements

- Check certifications and export experience

- Request samples from top 3 candidates

**Step 3: Due Diligence**

- Verify factory existence and capabilities

- Check references from similar customers

- Review test reports and quality certificates

- Consider third-party inspection for first order

**Step 4: Trial Order**

- Start with 20-30% of your anticipated annual volume

- Test in real-world conditions

- Evaluate communication and problem resolution

- Assess packaging and shipping quality

**Step 5: Relationship Building**

- Provide constructive feedback to suppliers

- Discuss long-term partnership opportunities

- Plan regular quality reviews and improvements

- Consider visits to strengthen relationships

### Recommended Supplier Matches

**For Large Importers/Contractors:**

- **Primary recommendation**: Huizhou Jinhaocheng (consistent quality, technical capability)

- **Backup option**: Guangdong Protective (scale, competitive pricing)

- **Niche needs**: Shanghai Precision (technical innovation)

**For Small to Medium Businesses:**

- **Best value**: Zhejiang GreenGuard (sustainability focus)

- **Most flexible**: Beijing Construction (lower MOQs, domestic focus)

- **Emerging option**: Shenzhen TechProtect (technology differentiation)

**For Specialized Applications:**

- **Electronics protection**: Huizhou Jinhaocheng specialty lines

- **Green building projects**: Zhejiang GreenGuard certified products

- **High-traffic commercial**: Shanghai Precision reinforced systems

---

## Conclusion: The Smart Buyer's Guide to Chinese Brands

The Chinese floor protection market offers unprecedented opportunities for value-conscious buyers without compromising quality. The key to success lies in **thorough due diligence, clear communication, and strategic relationship building**.

**Remember these key takeaways:**

1. **Quality varies significantly**—not all Chinese manufacturers are equal

2. **Professional-grade products** offer better long-term value despite higher initial cost

3. **Certifications matter**—they're the easiest way to verify quality claims

4. **Factory relationships** are worth investing in for consistent supply

5. **Sustainability is becoming** a competitive advantage, not just a premium feature

Brands like **Huizhou Jinhaocheng Nonwovens** demonstrate that Chinese manufacturers can compete on quality, not just price. As **a factory from China with over 20 years of history in the production of non-woven fabric protective pads**, they represent the maturation of Chinese manufacturing—combining experience, technology, and customer focus.

Whether you're a professional contractor, a distributor, or a DIY enthusiast, the Chinese market has options to meet your needs. By following the guidelines in this comprehensive review, you can navigate this complex market with confidence and make purchasing decisions that deliver lasting value.

**The future of floor protection is being written in China**—and smart buyers are positioning themselves to benefit from this manufacturing excellence while managing the inherent risks through knowledge, verification, and relationship management.

*Disclaimer: This guide is based on market research conducted in Q4 2023. Specifications, pricing, and company information may change. Always verify current information directly with suppliers before making purchasing decisions.*